Great news!

Recently, Singapore's Prime Minister and Minister of Finance Lawrence Wong announced the 2025 fiscal year budget and stated that an innovative plan will be launched this year to attract global entrepreneurs to set up businesses in Singapore.

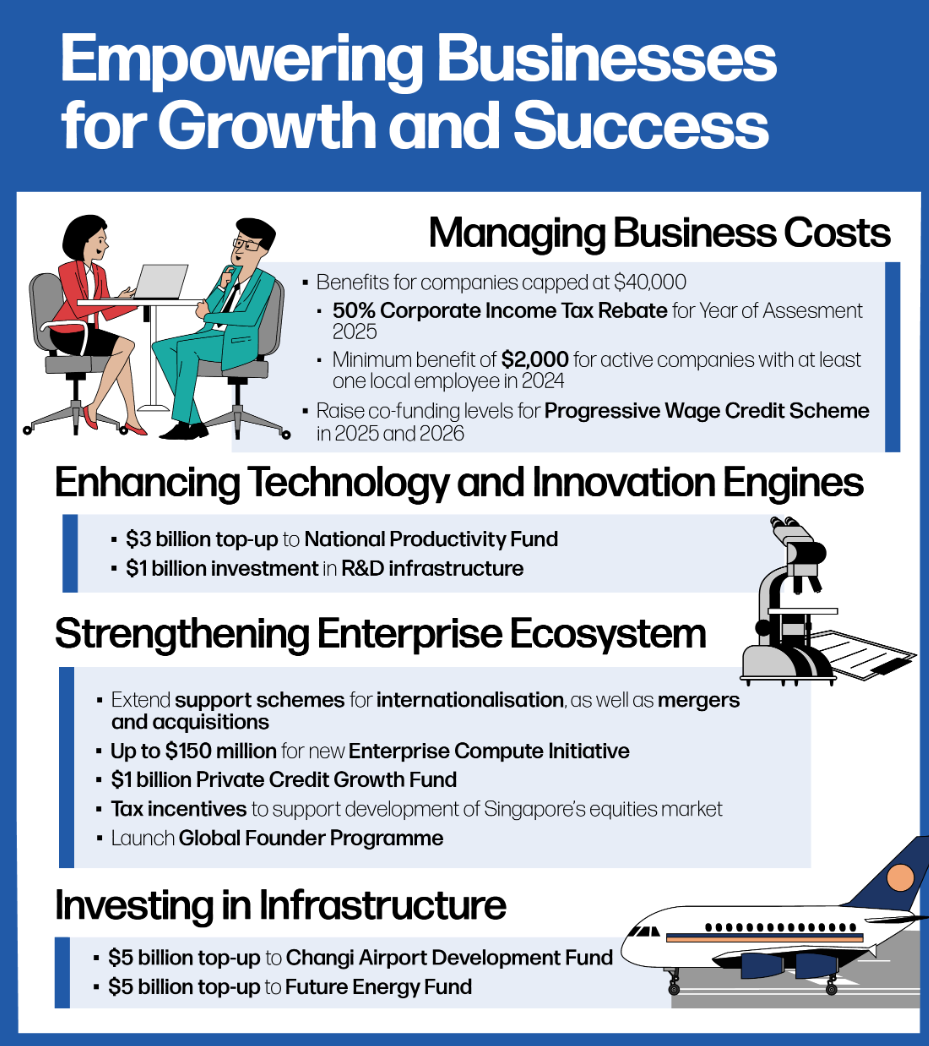

In addition, he also announced a series of incentives to promote business development.

01

Introducing new plans

Attracting global entrepreneurs

Currently, Singapore has cultivated many globally competitive startups and mature companies, but it is still committed to becoming a world-leading business incubator to promote the growth of more companies and the prosperity of Singapore's economy.

Singapore's Prime Minister and Minister of Finance Lawrence Wong announced in his 2025 fiscal year budget statement that the Economic Development Board will launch the Global Founder Programme this year.

Lawyer Wong emphasized that some startups are founded by global companies or experienced entrepreneurs, and the Economic Development Board has established close cooperative relations with these multinational companies and entrepreneurs.

The launch of this program can attract more global entrepreneurs to set up companies in Singapore, thereby injecting new impetus into Singapore's economic growth and job creation.

The participation conditions and incentives of the program have not yet been announced. Please wait patiently. Once there is the latest news, Xiaoxing will report it to you as soon as possible!

02

There are more favorable measures

(1) Companies and fund managers can enjoy tax incentives.

For Singapore companies and fund managers listed on the Singapore Exchange and enhancing local market economic activities in Singapore, they can enjoy tax incentives:

★ Companies that are listed on the Singapore Exchange for the first time: eligible companies can enjoy a 20% corporate tax reduction.

★ Companies that are listed on the Singapore Exchange for the first time: those who issue new shares at the same time can enjoy a 10% corporate tax reduction.

★ Companies with a market value of ≥ S$1 billion: the annual tax reduction limit is S$6 million.

★ Companies with a market value of < S$1 billion: the annual tax reduction limit is S$3 million.

★ Fund managers who invest in Singapore listed companies: enjoy tax incentives.

(2) Helping enterprises expand overseas markets.

To help enterprises expand their scale and enhance their international competitiveness, the government will extend a number of internationalization and M&A support policies:

★ Extend the subsidy limit of the Market Readiness Assistance program to March 31, 2026 to share the costs of overseas market promotion, business development and market setting of enterprises.

★ The Double Tax Deduction for Internationalisation program will be extended to December 31, 2030. Eligible investors can enjoy a 200% tax deduction on market expansion and investment development expenses.

★ Strengthen the Enterprise Financing Scheme, increase the trade loan limit to RMB 10 million; expand the scope of M&A loans beyond equity acquisitions to support target asset acquisitions from April 1, 2025 to March 31, 2030.

★ The Mergers and Acquisitions Scheme is extended to December 31, 2030, which means that Singapore companies that make qualified acquisitions can enjoy tax incentives.

In addition, Singapore's 2025 fiscal year budget also covers a number of measures such as corporate income tax refunds and cash subsidies, which shows Singapore's determination to create a paradise for business.

If you are interested in registering a company in Singapore or want to apply for Singapore identity, please contact Xingyunhai International, we will provide you with a tailor-made exclusive plan.

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece