The global currency has released water, and the property market is naturally the largest reservoir of funds.

The stimulating effect of the central banks of many countries on housing prices is still ongoing, and the Fed's interest rate hike has not yet seen the curb effect of the Fed's interest rate hike on the rising momentum of housing prices.

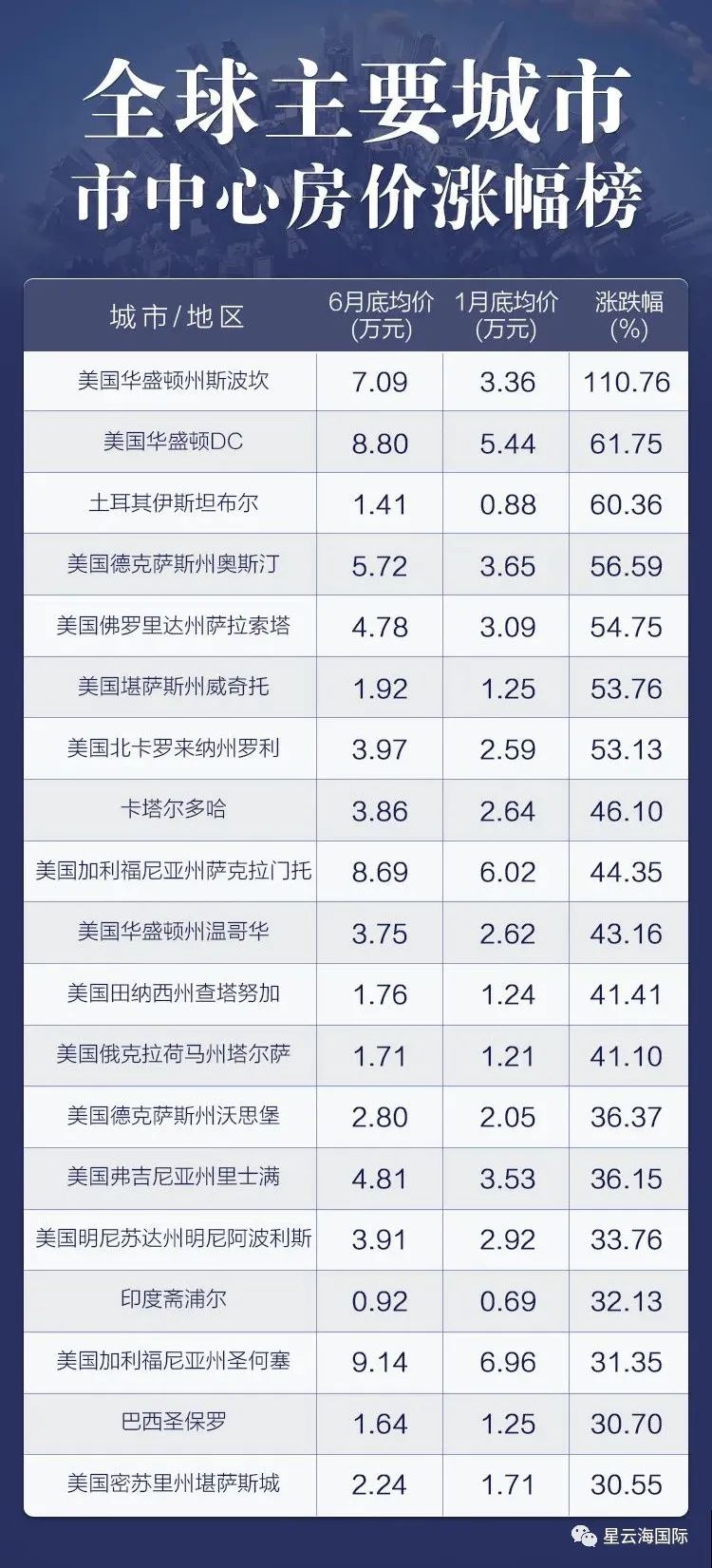

The "List of House Price Increases in Major Global Cities" shows that in RMB terms, house prices in more than 250 cities around the world rose in the first half of the year.

The United States accounted for 80% of the top 10 house price increases in major urban areas in the world. Among them, Spokane, Washington, rose more than 110%, ranking first.

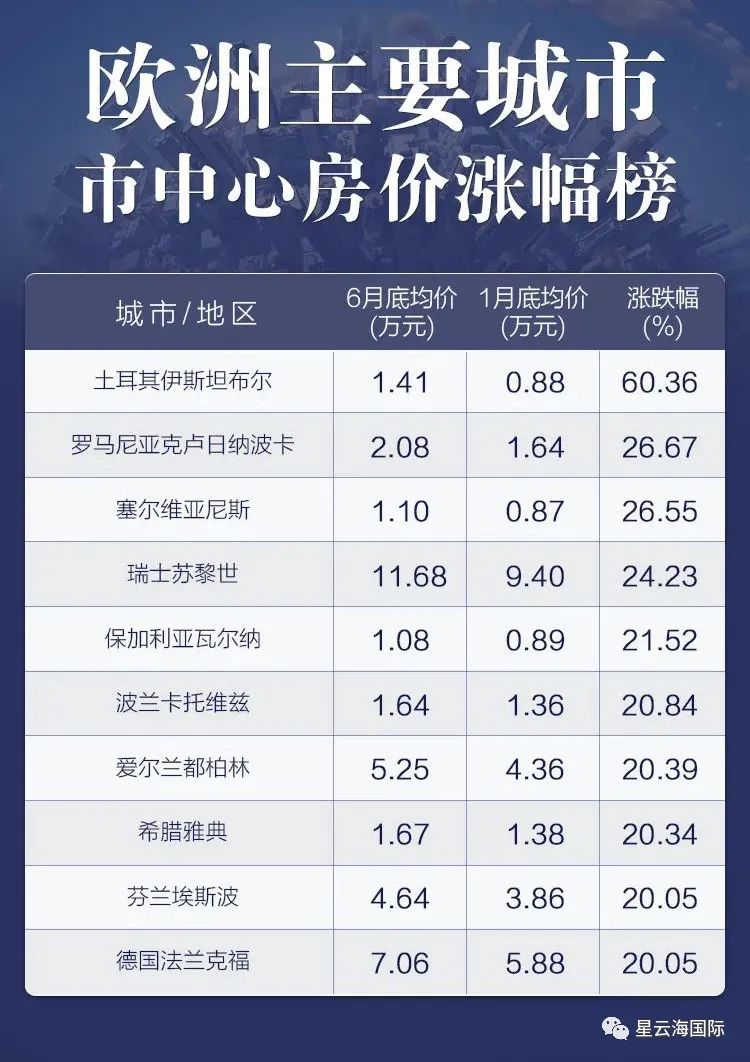

The city with the largest house price increase in Europe is Istanbul, Turkey, which performed very well.

01

Property prices in Istanbul, Turkey

3rd in the world, 1st in Europe

Istanbul, Turkey has become the city with the largest house price increase in Europe. The average price in the city center has risen from 8,782 yuan at the end of January to 14,083 yuan at the end of June, an increase of more than 60%, ranking third in the world and first in Europe.

Although Turkish housing prices continue to rise rapidly, it has not yet outpaced the depreciation rate of the Turkish currency lira. At the same time, since the central bank of Turkey maintains a policy of substantially negative and low interest rates, it is also very cost-effective to take out a loan to buy a house.

Attracted by multiple advantages, overseas investors have poured into Turkey's crazy "buying the real estate market".

Since 2020, the Turkish real estate market has been performing well under the influence of the epidemic, and the annual transaction volume has reached one million.

The latest data shows that in May 2022, Turkey's housing sales increased by 107.5% year-on-year to 122,768 units. Among them, Istanbul had the highest share of housing sales with 22,148 houses, accounting for 18.0%.

Investors who purchase real estate in Turkey can effectively resist post-epidemic inflation, realize asset preservation and appreciation, and enjoy the investment income while gaining the status of a major country and visa-free passports from more than 110 countries and regions. They can also apply for E-2 visas to springboard to the United States.

Therefore, although the investment threshold of the Turkish Citizenship by Investment Program has now entered the era of 400,000 US dollars, it still has great market competitiveness and investment attractiveness.

EUR/USD fell to 1:1 in a row, which is rare. For Chinese investors, the purchasing power of the renminbi has increased relatively, and it has become more cost-effective to allocate euro assets. If you plan to invest in Europe, immigrate, study abroad, etc., now is a good time to take advantage of this wave of market dips in Europe. (Click to review: The euro has fallen to a record low, and it is a good time to buy property and identity in Europe!)

02

Ho Chi Minh, Hanoi, Vietnam

Entering the top ten in Asia

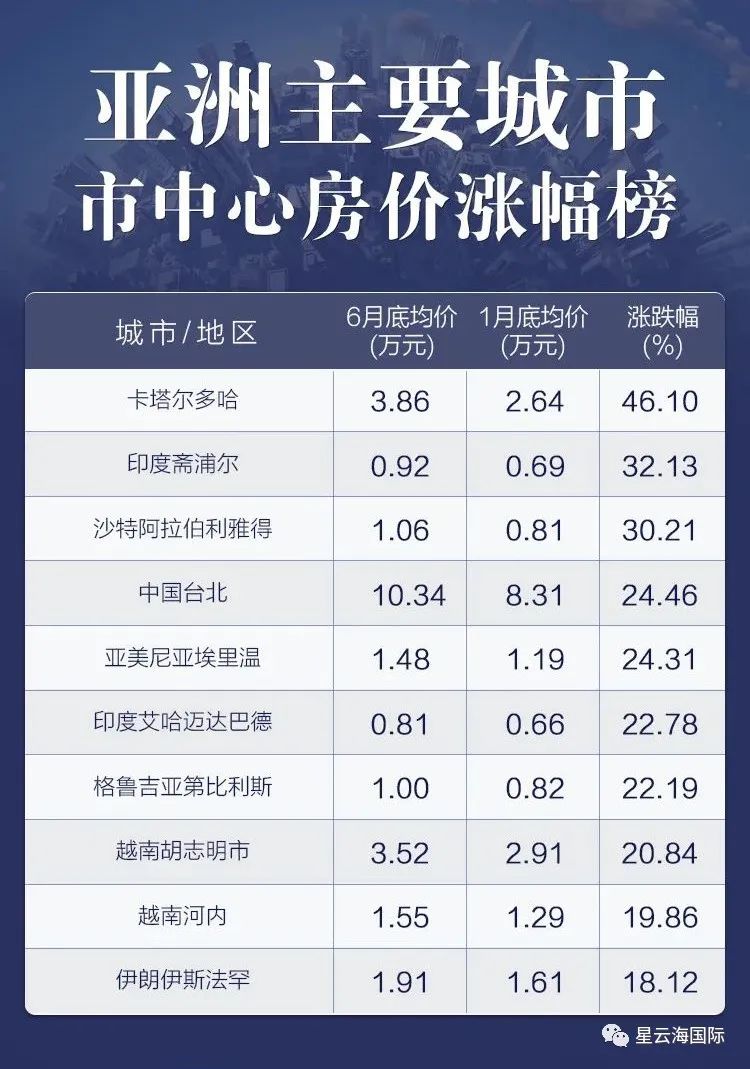

The overall growth of the East Asian market was halted due to the epidemic, and the property market performed poorly in the first half of this year.

But the potential stocks that have to be mentioned are Vietnam. The two major cities, Ho Chi Minh and Hanoi, entered the top ten of the list. Ho Chi Minh City’s housing prices rose by more than 20% in the first half of the year, with an average price of more than 35,000 yuan, roughly equivalent to Nanjing’s housing price level.

As a "rookie" in Southeast Asia, Vietnam's economic growth rate is on the rise. Coupled with the long-term demographic dividend, the future trend of housing prices is still bullish.

Many ultra-high net worth investors, including Li Ka-shing, are also very optimistic about the opportunity of Vietnam's economic take-off, and its subsidiary Cheung Kong Group has deployed high-end real estate in Ho Chi Minh City.

All in all, investors intend to diversify their asset allocation for overseas real estate investment, and Europe and Southeast Asia have their own advantages.

Many European countries, such as Turkey, Greece, Malta, Portugal, etc., have established housing immigration programs, allowing investors to "real estate + identity + education + taxation" with one stone.

However, some Asian countries such as Vietnam, Thailand and Singapore give investors more investment returns on the growth potential of "real estate".

It is recommended to choose according to your own needs and preferences. If you want to obtain an exclusive "Overseas Asset Allocation & Identity Planning Plan", you can leave a message in the comment area or contact Xiaoxing in the background, and we will answer you one-on-one.

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece