Latest news!

The Hong Kong SAR Government will announce the 2025/26 fiscal budget on February 26. The Hong Kong Taxation Institute recommends focusing on the implementation of tax and non-tax measures to attract overseas funds, enterprises and talents, and promote the development of important strategic industries.

01

Adjusting the salary tax rate and stamp duty policy

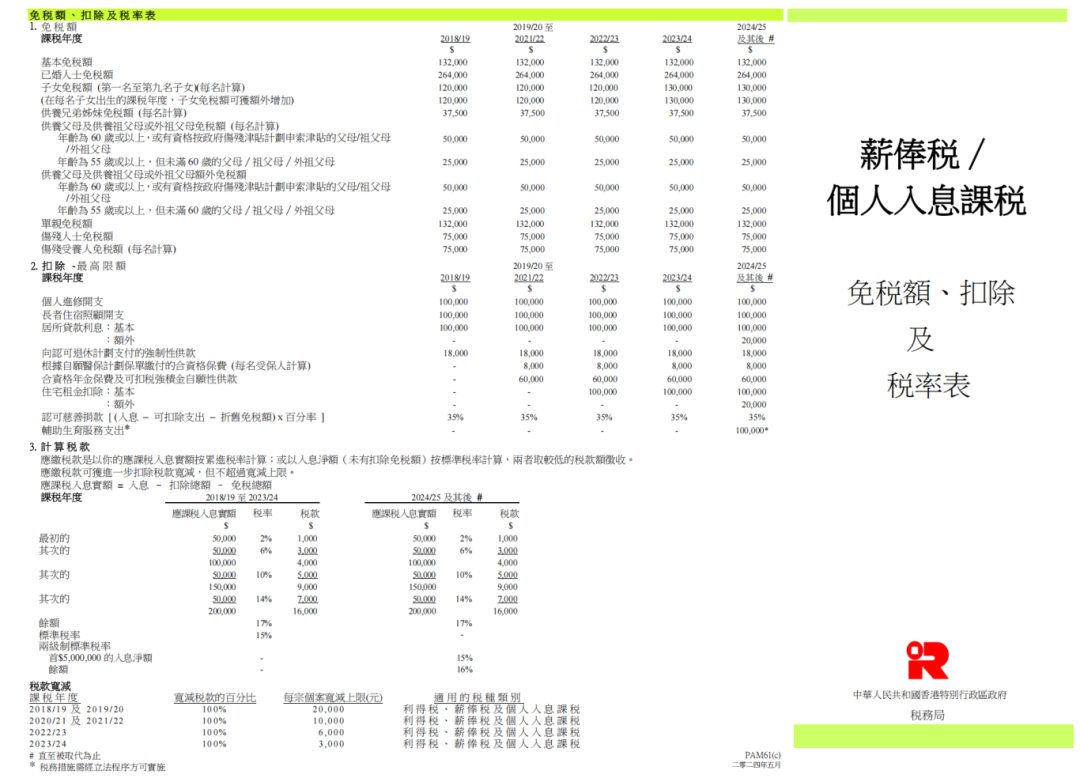

The Taxation Institute recommends that the highest marginal tax rate of the salary tax (personal income tax) progressive tax be reduced from 17% to 16%.

At the same time, increase the personal basic, married, dependent parents and child-rearing tax exemptions, and expand the salary tax deduction scope of private medical insurance plans.

Current salary tax/personal income tax

In terms of home purchase, the Taxation Institute recommends exempting the stamp duty for the first home with a market value of no more than 6.5 million yuan, provided that the buyer must live in the home for three consecutive years.

02

Expand the network of "Agreements for the Avoidance of Double Taxation"

Support the development of SMEs and family offices

In order to reduce the overseas tax costs of Hong Kong enterprises' overseas investments, the Tax Institute recommends that the Hong Kong government continue to expand the network of "Agreements for the Avoidance of Double Taxation", especially the countries along the "Belt and Road", and reduce the withholding tax rate on aircraft leasing income.

Currently, Hong Kong has signed relevant agreements with 51 countries and regions, covering Asia, Europe, Africa, the Middle East, the Americas and Oceania.

In terms of the capital market, the Institute recommends striving for high-quality companies that have been listed in the Mainland to go to Hong Kong for a secondary listing, while attracting Mainland sovereign funds to invest in Hong Kong's capital market.

In addition, it is recommended to optimize the tax incentives for family offices, such as incorporating all asset categories into the minimum asset threshold of 240 million yuan, and expanding the scope of tax exemption to qualified single family offices, as well as family investment holding entities managed by joint family offices or their special purpose entities.

For SMEs, it is recommended that organizations that meet the government's definition of "SMEs" increase the number of related entities that can enjoy the two-tier system of profits tax from one to two.

03

Reduce the tax rate for foreign artists and athletes

In order to attract international artists to hold concerts in Hong Kong and international athletes to participate in local events in Hong Kong, the Tax Institute recommends that the tax rate for entertainers and athletes who are not Hong Kong tax residents be reduced by 50%.

At the same time, if they do not submit receipts to verify actual expenses, the expense deduction will be increased from one-third of the total income to two-thirds.

04

Hong Kong attracts outstanding talents from all over the world

In short, Hong Kong has long attracted high-net-worth individuals from all over the world with its simple tax system and low tax rates, high-quality educational resources, and abundant development opportunities. According to the "2024 Billionaire Census" report, the number of billionaires in Hong Kong is second only to New York, ranking second in the world.

In addition, according to data from the Labour and Welfare Bureau, between 2023 and 2024, Hong Kong received more than 430,000 applications for various talent programs and approved more than 270,000, which fully demonstrates Hong Kong's strong attraction to global talents.

Now is the golden window period for applying for Hong Kong identity. If you also want to apply, please contact Xingyunhai International. We will provide you with a tailor-made exclusive plan.

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece