On November 29, Zoopla, one of the largest real estate portals in the UK, released a freshly released real estate index report.

According to the latest data, it is estimated that by the end of 2021, the UK will have a total of 1.5 million real estate transactions, and 1 out of every 16 houses has completed resale transactions. The busyness of the market has reached its highest point since 2007.

The UK is currently experiencing the hottest real estate market in 14 years.

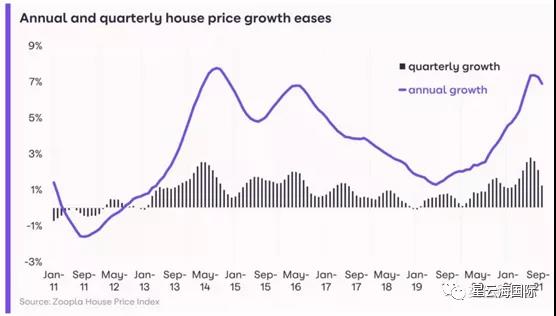

1. The annual increase in property prices is 6.9%

According to Zoopla’s report, in the year ending October 2021, the average house price in the UK rose by 6.9%, which is close to a seven-year high and higher than the 3.5% increase in the same period last year (2020).

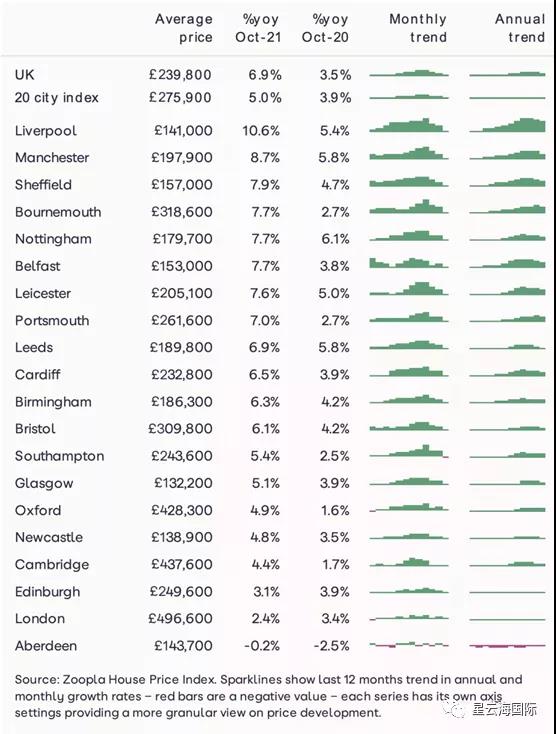

As far as major cities are concerned, in the past year, the three cities of Liverpool, Manchester and Sheffield led the country in house price growth, with increases of 10.6%, 8.7% and 7.9% respectively. The specific data can be seen in the following table:

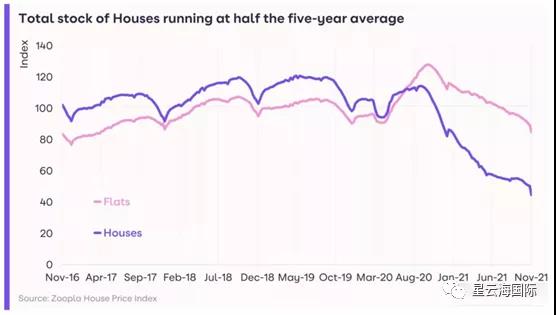

2. The supply of villa real estate is tight

The supply of different types of real estate in the UK this year varies considerably.

The current house supply level in the UK is 55% lower than the five-year average.

The supply of flats in the UK this year is 15% lower than the five-year average.

Zoopla analysis pointed out that the epidemic has greatly increased the demand for houses of the British people, which has led to a substantial reduction in the supply of houses. This also shows that the British who have experienced the epidemic now have greater demand for space than before.

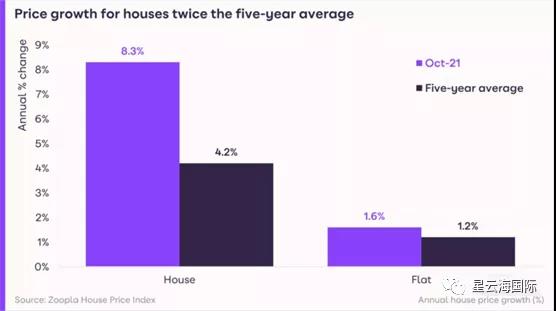

The inventory comparison is also reflected in price growth.

The average price of house properties increased by 8.3% year-on-year, which was twice the 5-year average increase of 4.2%.

The average price of flat properties increased by 1.6%, slightly higher than the 5-year average increase of 1.2%.

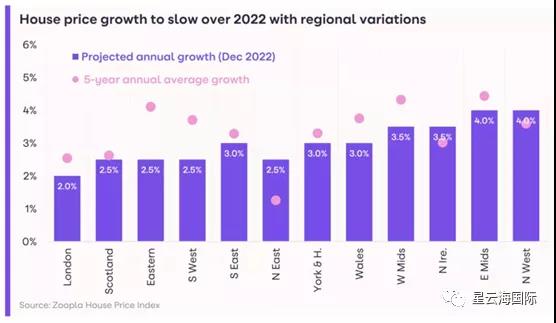

3. Housing prices are expected to grow by 3% in 2022

Zoopla predicts that the growth rate of house prices in the UK will slow down in the coming months and 2022. It is expected that the annual rate of house prices will stabilize at around 3% by the end of 2022.

Zoopla pointed out in the report conclusion that in terms of supply and demand, the demand of British buyers will continue to be strong in 2022; at the same time, as various construction activities and market behaviors gradually normalize after the unblocking, the housing supply problem in the UK will Will get a certain degree of relief.

However, the lower supply level will still support housing prices next year.

Under the influence of the epidemic, there is still such a large transaction volume, which shows that the British economy is recovering, a lot of overseas capital and talents are pouring into the British market, and the demand for housing is constantly increasing. In the future, the recovery of the British economy will promote the continuous rise of property prices, and the trend of maintaining growth will not change.

In addition, it has become inevitable that the UK will raise interest rates on mortgages in 2022. This is the best time, and it is a rare investment opportunity for many investors.

If you are also interested in real estate in the UK, please inquire for details~

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece